Concerns about the threat of artificial intelligence (AI) and a sudden loss of confidence in private credit bets have led to another sharp decline in the stocks of banks and asset management companies.

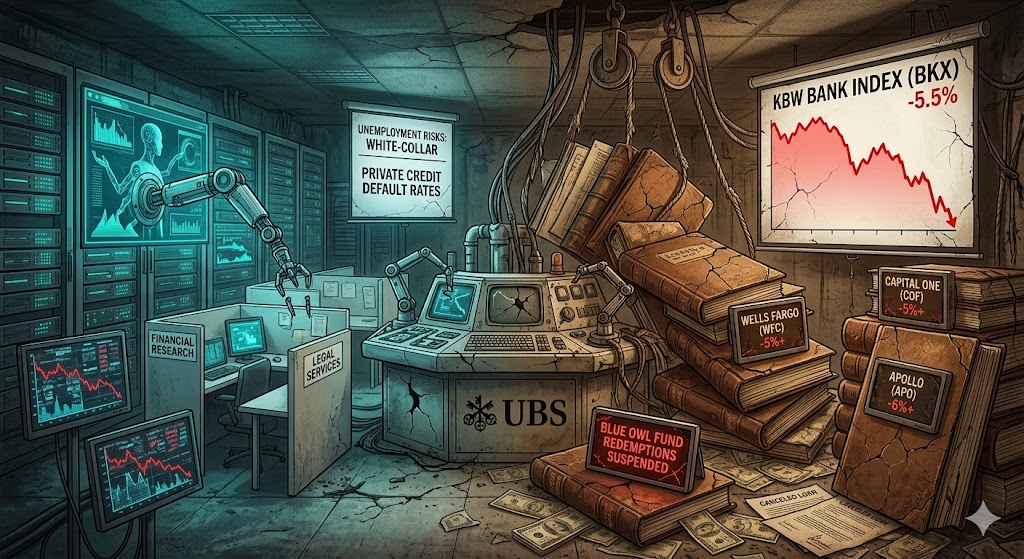

The KBW Bank Index (BKX) plummeted 5.5% on Friday, marking its lowest level since early December, and is on track for the largest single-day drop since the trade turbulence in April. All 23 constituent stocks of the index fell by at least 1.7%, with Wells Fargo (NYSE:WFC) and KeyCorp (NYSE:KEY) seeing declines of more than 5%. Major Wall Street firms like Goldman Sachs (NYSE:GS), Citigroup (NYSE:C), and Morgan Stanley (NYSE:MS) also experienced losses.

This month, lending institutions, payment service providers, and asset management companies have been hit hard, with the biggest shocks coming from new AI applications and the struggles in private credit. Credit spreads have also started to widen, and the collapse of a Wall Street-backed UK mortgage lender has heightened concerns about rising default rates in the opaque private lending sector.

In the recent market volatility driven by AI, the investment-grade bond market, which had once been seen as a safe haven, is now showing signs of pressure. According to Bloomberg, global comparable bond premiums have widened by nearly 4 basis points this week, the largest increase since early November.

Friday’s sell-off extended the trend seen in recent weeks, with AI concerns sweeping across nearly every sector of the financial industry. Wealth management firms, insurance brokers, large banks, boutique financial advisors, financial data providers, and even exchanges have been affected.

The latest move by Block (NYSE:XYZ) added to the shockwaves, as the company cut nearly half of its workforce, once again highlighting how AI could threaten the livelihoods of many professionals.

Earlier this month, Altruist Corp. launched a tool to help financial advisors develop personalized strategies for clients and create payrolls, account statements, and other documents. Since then, stocks related to wealth management have continued to decline.

The biggest blow came last week when Anthropic released a new model designed to automate financial research and legal services, triggering a sell-off in these stocks.

Bloomberg Industry Research analyst Chen Herman said, “There are many unknowns regarding the pace of AI adoption and its potentially disruptive effects, and the banking sector is entering a period of greater volatility. The rise in Treasury prices, alongside the widening of credit spreads, indicates a risk-off sentiment in the market.”

The sell-off also affected credit card and payment service providers, with Synchrony Financial (NYSE:SYF), American Express (NYSE:AXP), and Capital One Financial (NYSE:COF) seeing stock declines of at least 5%. Alternative asset management companies also took a significant hit, with Apollo Global Management (NYSE:APO), KKR & Co (NYSE:KKR), and Ares Management (NYSE:ARES) dropping by at least 6%.

Brian Finneran of Truist wrote in a report to clients, “This morning, the market is selling off all stocks sensitive to credit ratings. Given that American Express (NYSE:AXP) stock performance is more closely tied to potential white-collar unemployment, experts are focusing more on this stock.”

Just months after JPMorgan CEO Jamie Dimon warned that the collapse of auto loan companies might not be an isolated incident, more concerning signs are emerging in the credit markets.

Earlier this month, MFS creditors warned of $1.3 billion in losses due to a shortage of loan collateral; meanwhile, BlackRock’s private debt fund plummeted after cutting its dividend, causing a ripple effect in the prices of other business development companies.

Private credit management firm Invico Capital Corp. has developed a plan to address large investor redemption requests for one of its funds. Blue Owl Capital Inc. suspended redemptions for one of its funds last week and decided to sell off some assets to repay investors. The company’s stock is heading toward its worst month ever.

“Negative news from the credit market, released by a London-based financial solutions company, has caused trouble for companies like Apollo Group and Jefferies, and investors are starting to worry that this negative sentiment could spread,” said Matt Maley, Chief Market Strategist at Miller Tabak + Co LLC. “Even if this issue doesn’t spread, the growing problems in the credit market still pose risks of losses for financial companies,” he added.